4 Examples of Life Insurance Analysis Saving Millions

Coordinating an insurance analysis can be intimidating unless you have the right team of experts. Refer to the four examples detailed below that illustrate how portfolio management, underwriting advocacy, and expert case design could save millions of dollars for clients similar to those that you advise.

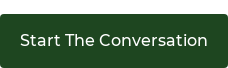

1 Mr. Monte Carlo is planning his retirement and wants leave $6M to his children upon his death. He requested that TDC Life evaluate the funds available in his existing investment portfolio. After a series of stress tests that include numerous hypothetical scenarios, it was found that his likelihood of $6M value at death= 75%, and the likelihood of $28M at death= 30%.

The TDC Life Difference: We developed a solution that uses existing portfolio assets to provide lifetime income as well as purchased an efficiently designed life insurance policy to assure the $6M legacy value at death (with a 98% probability of success). Next, we purchased $1M of long-term care insurance through a policy rider, allowing access to a portion of the policy’s death benefit for long-term care expenses totaling $35M in assets (with a 50% probability of success).

2 Mr. Executive served as President of one of the world’s leading automobile companies who's net worth grew to over $300M. Currently in his mid 70’s, he is only now inquiring about life insurance. He is uninsurable and his wife is in less-than-ideal health. His estate planning advisor recommended that he stack multiple life insurance policies across six carriers, but ultimately sought a second opinion from TDC Life.

The TDC Difference: It was immediately determined that TDC Life could create a more efficient IRR (Internal Rate of Return) for Mrs. Executive’s life expectancy, 5.98% to 4.60% resulting in a 30% increase in efficiency. Mr. Executive then asked TDC Life to create a custom recommendation for life insurance, allowing us to break away from the existing portfolio and design a new plan to best serve his family.

To begin with, we placed individual life insurance on Mrs. Executive, instead of “second-to-die.” Next, we placed all new life insurance with one carrier, with a growing death benefit starting at $24M, and maxing out at $240M at Mrs. Executive’s age 95. Lastly, we utilized an ROP (Return of Premium) rider with 6% compounding interest on all premiums paid.

Ultimately this resulted in a significantly increased death benefit, drastically lower premiums, and an improved internal rate of return.

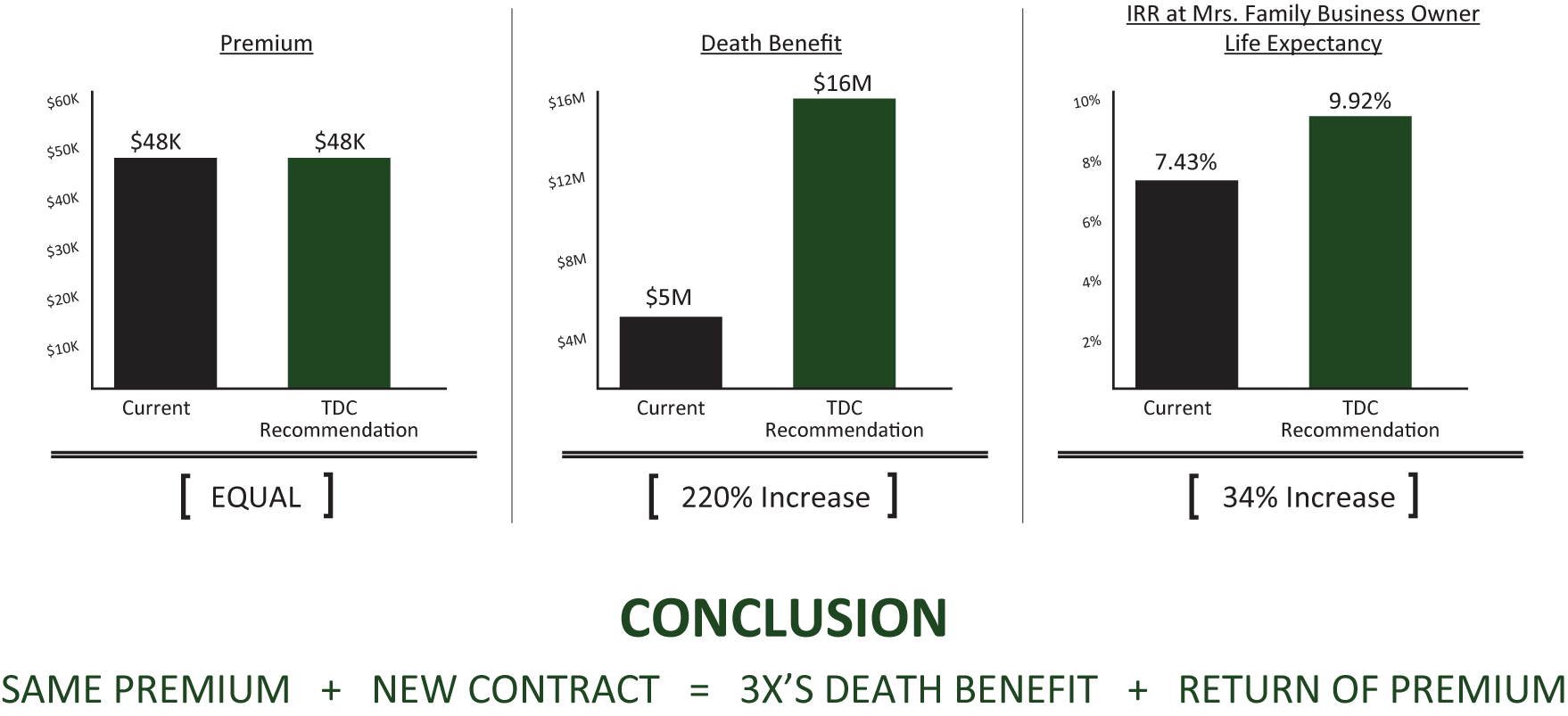

3 Mr. and Mrs. Family Business Owner purchased a $5M SUL (Survivorship Universal Life) policy, and paid annual premiums of $48,000/year. The policy has a death benefit that grows as the policy value increases. Upon purchase, the agent showed the policy performing at an 8% growth rate annually.

After some years, TDC Life reviewed the policy. It became clear that the policy was only growing at a rate of 4.85%, and Mr. and Mrs. Family Business Owner actually needed $15M in coverage, three times the current amount in the policy.

The TDC Difference: Immediately executed a 1035 exchange of the current policy’s cash value into a new $16M SUL policy (220% increase) with the same annual premium dollar amount and added a Return of Premium (ROP) feature, meaning the death benefit is guaranteed to grow by the amount of total premiums paid. IRR (Internal Rate of Return) at age 83 for Mrs. Family Business Owner increased to 9.92%, a 34% increase from the previous plans 7.43%. Finally, the Income and Estate Tax Free IRR at Mrs. Family Business Owner’s life expectancy (age 83) landed at 16.53%.

Ultimately, the same premiums with a TDC contract resulted in 3x the death benefit and a complete return of premiums for the family.

4 Mr. CEO is seeking income replacement coverage but because his income exceeds $1.3M annually, does not qualify under traditional disability carriers.

The TDC Difference: By combining group and individual disability programs, we placed $17,500/month coverage on Mr. CEO, which only accounted for a 16% income replacement in the case he were to become disabled. We then attached a Lloyd’s of London personal high limit disability policy that would deliver an additional monthly benefit of $47,500/month to Mr. CEO for a period of 60 months.

Ultimately, TDC Life ensured a portfolio to disability policies to safeguard a supplementary $2.8M of after-tax earnings to keep the client, his family, and assets on track for retirement in the case Mr. CEO should become disabled.

In all cases, TDC Life provides personalized, objective advice to the clients of our partner advisors. Through best-in-class underwriting advocacy and product design, we are able to deliver sophisticated and strategic wealth transfer solutions. If you are interested in discussing how TDC Life could be a life insurance resource on your team, click the link below to schedule time with one of our experts.

Why Advisors Choose TDC Life:

|