Impact Success Story: Dr. and Dr. IRA

September 29, 2022

As you know, we here at TDC Life are all about helping you and your clients find innovative and efficient life insurance solutions to cover their unique family and business risks. Here is one such case whereby.

The Clients:

- A married couple of two doctors, both aged 65 residing in South Carolina.

The Situation:

- Prolific avers resulting in their estate having grown to a taxable level

- Historically had converted some of their IRA to Roth IRAs and were contemplating doing more with their remaining $9.78M in traditional IRAs

The Options They Were Contemplating:

- Keep the IRA, take RMDs and invest the net dollars after tax – any investment would be income and estate taxable

- Convert to a ROTH by paying tax now, the ROTH would still be estate taxable

Our Assessment:

- Withdrawals and RMDs to fund a specially designed second to die policy owned inside of an irrevocable trust

- This unique design only needs five relatively small premiums to provide 15 years of premium holiday

- Additionally, the return of premium death benefit (ROP) feature increases the death benefit by every premium dollar paid

THE RESULT

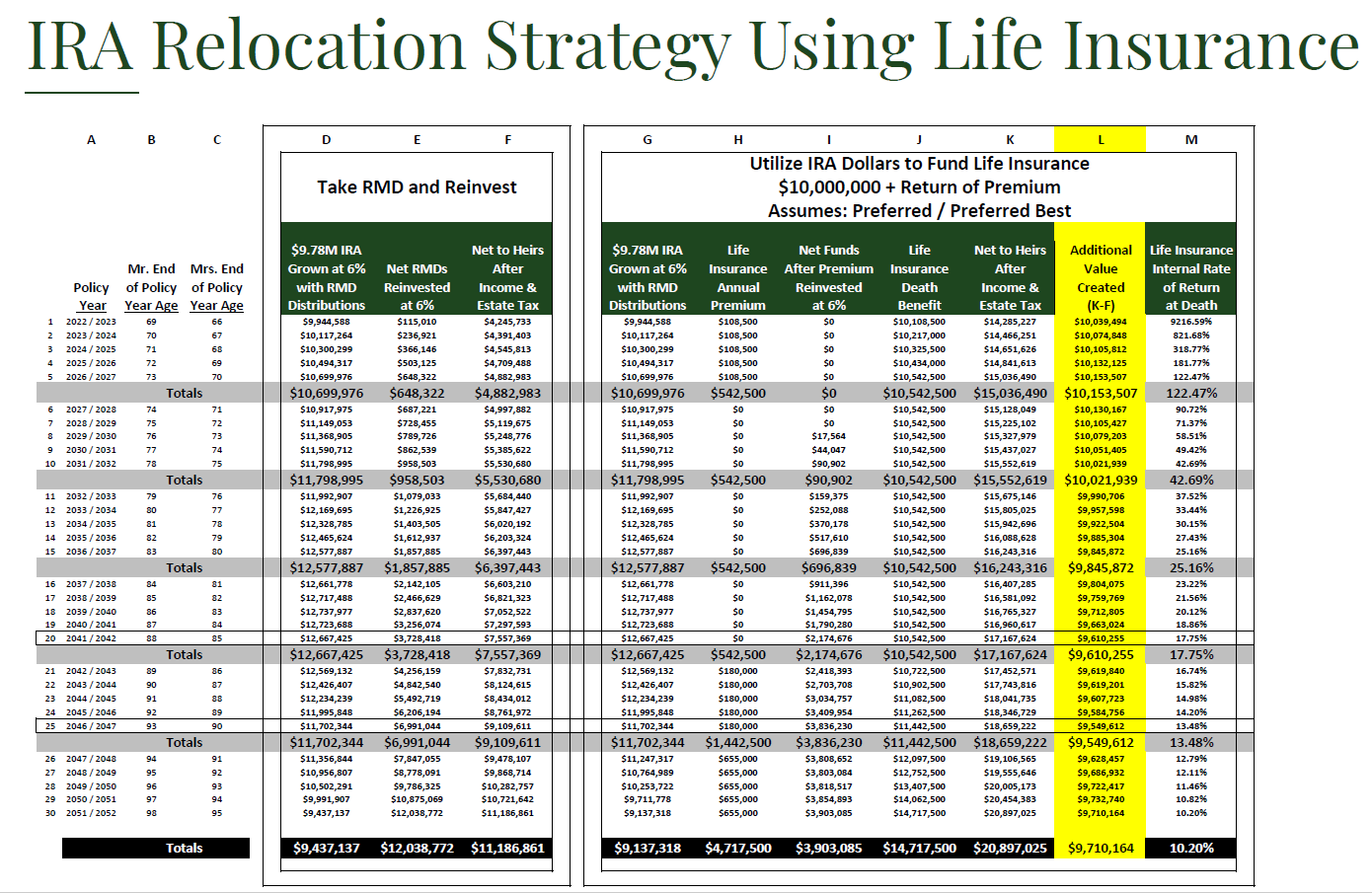

As you will see in the below illustration, this strategy was able to produce over $9M more after tax benefits to the family.

Click to enlarge illustration of results

Click to enlarge illustration of results

Who Is This Strategy Best For?

- In essence this strategy is converting an income and estate taxable IRA into to tax free life insurance.

- There are many clients for which this would work, here are some parameters:

- Legacy goals + 50 years or older with a potentially taxable estate and wealth transfer goals

- Insurable, could be husband or wife or both

- Adding a charitable component can super charge the strategy (reduce RMD with a QCD, give the IRA to charity at death and replace the IRA value with the life insurance)

TDC Life can model out all alternatives to this strategy, such as Roth Conversions and holding the IRA to confirm this is in the client’s best interest. Contact us today if you have a client situation where this approach could benefit them.