Case Study: Split-Dollar Business Coverage

May 12, 2021

Tax Efficient Income Strategy

+ Executive has substantial retained cash inside of his C-Corp and wants to access cash without being double taxed.

+ Split dollar recommendation allows the following:

» Business uses retained cash to fund insurance for benefit of Executive and gets repaid at death or policy surrender.

» Executive receives lifetime access to cash income tax-free and estate-tax free death benefit for a relatively small annual economic benefit tax cost.

The Result

We looked at two different ways to fund the policy. Here are the results:

15 Year Funding:

+ $50,000/year for 15 years ($750,000 total)

+ Tax-free income totaling $1,760,000 from ages 65-85

+ Death benefit of $1,313,000 at age 100 payable to family

+ Gross interest rate needed on hypothetical taxable investment to match results - 43.02%

4 Year Funding:

+ $250,000/year for 4 years ($1,000,000 total)

+ Tax-free income totaling $3,190,000 from ages 65-85

+ Death benefit of $1,843,000 at age 100 payable to family

+ Gross interest rate needed on hypothetical taxable investment to match results - 34.82%

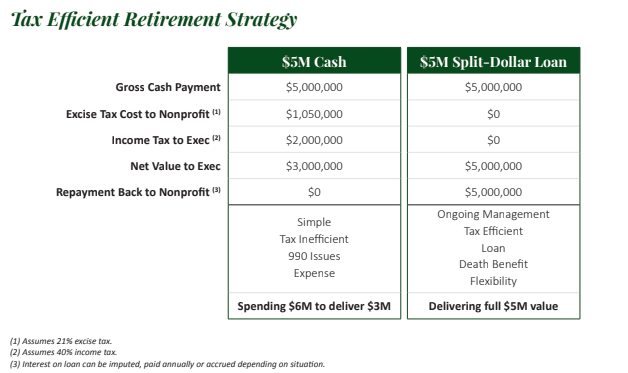

College Coaches Paid with Split-Dollar Life InsuranceSplit Dollar Life Insurance is an arrangement between two parties to split the cost and benefits of a life insurance policy. Below is a specific example of how Split-Dollar Life Insurance compensation is becoming more and more common amongst college coaches - and this article gives the details on coaches like Bo Schembechler, Jim Harbaugh, Dawn Staley and so many more! |