TDC Life Open Resources

Fall is here, and that means the clock has started click on the final quarter of the year to consider several important elements of your clients financial plan. One of those elements is their life...

Impact Success Story: Dr. and Dr. IRA

September 29, 2022As you know, we here at TDC Life are all about helping you and your clients find innovative and efficient life insurance solutions to cover their unique family and business risks. Here is one such...

One of the most frequently asked questions we receive when planning for term insurance is, “How long of an increment do I need?”

Where Will Your Client’s Collector Cars Go When They Do?

July 06, 2022Do you have a plan or a vision for your car collection? Have you taken the necessary steps to ensure your intentions are met after you are gone? Is it the best plan?

As you well know, the key to establishing and growing relationships with your clients is to simplify the complex and provide them the best solutions for their unique needs. And you do this over and...

"Hi everybody, Tyler Horning here, Principal at TDC Life. Today I wanted to talk to you about overfunding, underfunding, and not letting life insurance policies lapse."

Employer-Owned Life Insurance: Requirements of Section 101(j)

December 09, 2021Many practitioners are not familiar with the specific ins and outs of owning life insurance inside of a company, even though the rules changed back in 2006. If your clients need the protection of key...

Tyler Horning Named a Top Financial Security Professional by Forbes

October 20, 2021TDC Life is thrilled to announce that Tyler Horning has been selected as a Top Financial Security Professional by Forbes and SHOOK Research.

Fixing the Qualified Plan Wealth Transfer Problem

October 11, 2021What's the problem? Many believe that qualified plans and annuities are efficient savings vehicles for retirement. For many Americans this is true. However, for clients that have personal financial...

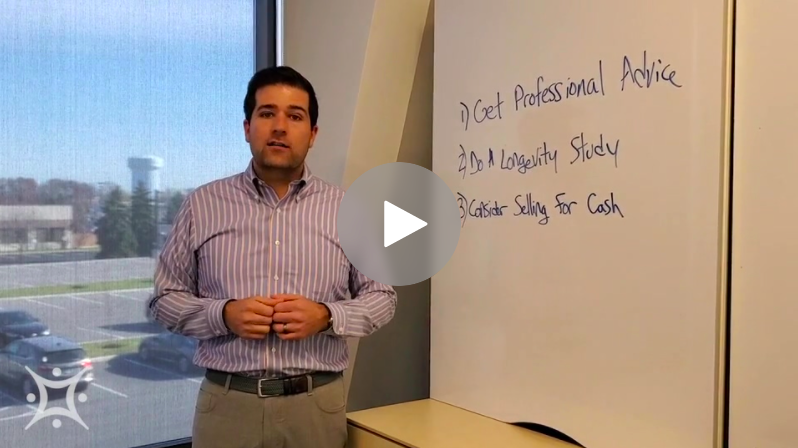

3 Types of Clients: Uneducated

July 27, 2021This week is our final post discussing how you can identify if your client may need a life insurance analysis and what additional value that you can bring to them in this discussion. Again, we ask...

-thumb-1.jpeg)

-thumb.jpeg)

.jpg)